Federal Tax Ombudsman Jobs in Pakistan 2024 – Apply Online

Current recruitment information for positions at the Federal Tax Ombudsman Secretariat is outlined in Federal Tax Ombudsman Jobs 2024. The Employment Outlook for 2024, encompassing details on the online application processes, has been published in the Daily DAWN.

Nationals of Pakistan are currently eligible to apply for FTO positions. Before submitting applications for these employment opportunities, candidates are encouraged to thoroughly review the eligibility requirements and additional terms and conditions that are specified on the FTO website (www.fto.gov.pk/ftojobs).

Details About Federal Tax Ombudsman Jobs:

| Industry | Government |

| Hiring Organisation | Federal Tax Ombudsman |

| Jobs Location | Pakistan |

| Education Requirements | Bachelor | Master | BS |

| Vacancies | 200+ |

| Newspaper | Express. Jang |

| Address | Director (Admn) Federal Ombudsman Secretariat, 5-A Constitution Avenue, Islamabad, Pakistan |

Benefits of Federal Tax Ombudsman Jobs in Pakistan:

- Service to the public: By representing the Federal Tax Ombudsman Secretariat and resolving taxpayer concerns, employees have the opportunity to positively influence the public. It entails assisting individuals in navigating intricate tax issues and promoting equity within the tax system.

- Approach to Problem-Solving: To address complaints and disputes, Federal Tax Ombudsman Secretariat personnel are frequently required to solve complex problems. Engaging in the resolution of taxpayer issues can engender intellectual stimulation and a feeling of fulfillment.

- Comprehending Legal and Regulatory Aspects: The position may require an in-depth knowledge of tax regulations, laws, and procedures. Those with an interest in the legal and regulatory facets of taxation may find this information to be significant.

- Skills in Advocacy and Mediation: A position involving taxpayer complaints necessitates proficient advocacy and mediation abilities. Employees may serve as intermediaries between tax authorities and taxpayers, attempting to reach equitable and just resolutions.

- Government Benefits for Employment: Frequently, government employment entails perks like medical insurance, retirement savings, and job security. The Federal Tax Ombudsman Secretariat may offer the aforementioned benefits.

- Advancements in Professional Development: There may be opportunities for professional development available to those employed in this capacity, such as training in dispute resolution techniques and tax legislation. This may expand their career advancement opportunities and improve their skill set.

- Enhancement of Transparency: Through their involvement in resolving taxpayer grievances and upholding the integrity of tax procedures, personnel contribute to the system’s transparency and accountability. Thus, public confidence in government institutions may be bolstered.

- A Confusion of Duties: A variety of responsibilities may be associated with this position, such as investigating complaints, proposing solutions, and conducting investigations. This diversity can contribute to the job’s appeal and vitality.

- Promotion of Networking Opportunities: Employment within a government agency affords individuals the chance to establish professional connections with individuals who are knowledgeable in the domains of public administration, taxation, and law. Developing such connections can be advantageous for professional advancement.

- Satisfaction at Work: Achieving favorable outcomes for taxpayers and resolving their complaints can contribute significantly to an individual’s job satisfaction. It can be gratifying to know that one’s efforts contribute directly to the welfare of taxpayers and the integrity of the tax system.

Check Also: Federal Board of Revenue (FBR) Jobs – Apply Now

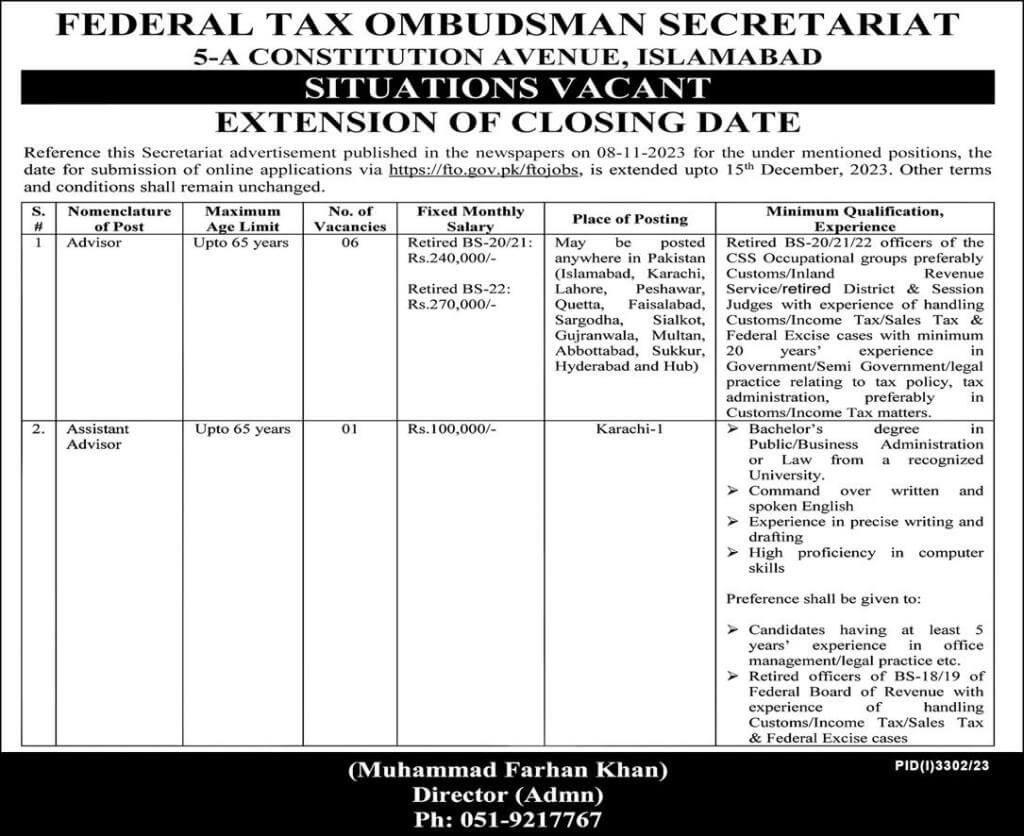

Jobs Positions:

- Advisor

- Assistant Advisor

How to Apply for Federal Tax Ombudsman Jobs:

It is highly recommended that applicants utilize the official website, www.fto.gov.pk/ftojobs, to submit their applications.

Applicants for all other positions are required to submit their applications in writing to the Federal Tax Ombudsman Secretariat, located at 5-A Constitution Avenue in Islamabad.

Advertisement:

People Also Ask:

-

What are the responsibilities of Pakistan’s Ombudsman?

The ombudsman possesses the same powers as a Civil Court under the code of civil procedure for summoning and compelling the attendance of any person, compelling the production of documents, receiving testimony on affidavits, and issuing commissions for the examination of witnesses.

-

Who is Pakistan’s current federal Ombudsman?

Syed Tahir Shahbaz , Wafaqi Mohtasib (Ombudsman) of Pakistan

Prior to his nomination as Wafaqi Mohtasib, he served as Secretary of the Government of Pakistan’s Establishment Division. He received his LL.M. and M.Sc. from Karachi University. -

Who appoints Pakistan’s federal Ombudsman?

The president appoints the Mohtasib for a four-year term, which cannot be extended or renewed.